1. Money is almost always in “motion”

I often hear people talk about savings in a static manner. I have $5,000 in the bank. If I budget properly, I will have $6,000 next month. Once I have $25,000, I’ll put down a downpayment on a house!

When you save, you become an economic force multiplier. Your savings get loaned out minus some fractional reserve (typically 10%) to the banks customers. So, if you put in $100, the bank might loan $90 to other customers and keep %10 in reserve in case bank customers decide to withdraw cash.

The recipient of the bank loan also deposits the loan into a bank. That means:

$100 -> $90 -> $81…

If you do the math, an initial deposit of $100 leads to about $900 in loans ($1000 in money flowing in the economy). This system works as long as all the banks customers withdraw their accounts at the same time (a run on the bank).

The bank of course charges interest on those loans and only pays a fraction back to it’s depositors. That’s how they make money! Which leads to…

2. Investors see savings as a loss…except…

If you read the first chapter of Investments by Bodie, you’ll notice something odd. Investors never compare their investments to a savings accounts?

Investor compare investment returns to U.S. Treasury Bonds or T-Bill (or it’s equivalent in the UK..etc). Why? U.S. government has a very low probability of defaulting, it almost always has a better return rate than a savings accounts (usually) and it can meet it’s obligations by printing money! Let’s sample some recent T-Bill rates:

| Date | 1 Month | 1 Year | 5 Year | 10 Year | 30 Year |

|---|---|---|---|---|---|

| June 1, 2018 | 1.74 | 2.28 | 2.74 | 2.89 | 3.04 |

| June 4, 2018 | 1.77 | 2.3 | 2.78 | 2.94 | 3.08 |

| June 5, 2018 | 1.82 | 2.32 | 2.76 | 2.92 | 3.07 |

| June 6, 2018 | 1.81 | 2.32 | 2.81 | 2.97 | 3.13 |

| June 7, 2018 | 1.78 | 2.31 | 2.77 | 2.93 | 3.08 |

| June 8, 2018 | 1.78 | 2.3 | 2.77 | 2.93 | 3.08 |

| June 11, 2018 | 1.82 | 2.32 | 2.8 | 2.96 | 3.1 |

Companies reflect a similar attitude when it concerns saving money! They like generating cash and having it present to pay for operating expenses, but they don’t want to hoard cash for it’s own sake. Companies typically reinvest cash in the business to create a greater return or return cash back to its shareholders when they can’t. If a business can’t create a good return on your money (due to maybe a saturated market), it is probably best that they return the capital so that it can be employed in other opportunities.

Cash is still king! If you don’t generate cash quick enough, you will go broke! If you don’t have cash or other liquid assets available, it’s hard to take advantage of price drops in assets (in say stocks). Cash is prized for it’s liquidity, but represents an opportunity cost in the medium to long-term.

3. Oh no! Inflation!

Ever hear people talk about when the price of bread was $.10? Do you feel like the price of coffee has doubled over the last 10+ years?

Based on the CFA level 1 economics section, most governments target an inflation rate between 1-2%! They avoid 0%, because there is a risk of deflation or negative inflation rates. Why invest in a business, if by holding money you can buy more goods? The opposite extreme is hyperinflation. At 10% inflation, a $20,000 car would be worth $32,000 in 5-years and $52,000 n 10-years. 2% inflation equivalent is $22,000 and $24,200 respectively. Having low inflation promotes investing, while preventing extreme changes in price!

How does inflation impact retirement? If you retire in 35-years and inflation is 2%, the money in your bank will be worth 50% of it’s current value!

How do investors think about this? They take the risk-free rate (T-Bill) and apply expected inflation to it. This is called the nominal return rate! They then add a premium on top of that for the risk of default, liquidity of a market and the opportunity cost of long maturities. Investors expect investments to compensate for inflation and risk!

4. Equity vs Liability?

I was reintroduced to the accounting equation recently:

Assets = Liabilities + Owner’s Equity

Assets is the property of a business. Liabilities are 3rd party claims on your business: a bank loan or unfulfilled customer order. Owner’s equity is how much value you own in your business after paying of loans and other obligations!

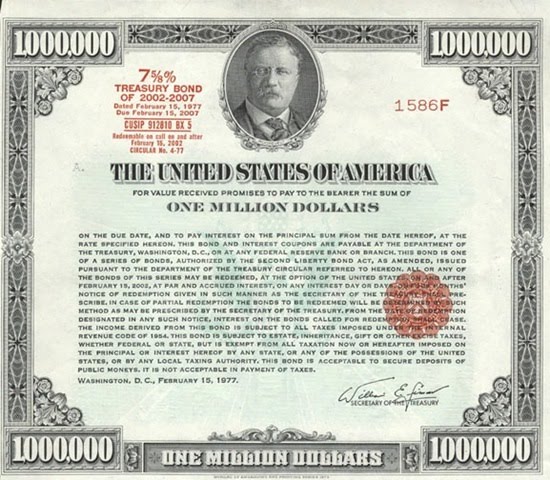

Investors can be part of either the liabilities or equities side of this equation! You can either loan your money to a business or buy a claim in that business. Giving a business or government a loan with an interest rate is called a bond. Buying a stake or becoming a owner of a business is called stock.

Bonds:

Bonds are less risky! When a company goes bankrupt, they have to pay off their debtors first before claiming anything left over in the business! On the other hand, bonds have no claim on the businesses outside of interest and principal payments (for the most part). That is, you get paid interest for a fixed number of years (or months) and then you get your loan amount back! The business owes you nothing afterwards!

Stock:

Common Stock is a claim or slice of a business. When a company makes makes a profit (after paying interest), it has a choice of reinvesting it into the business or paying it back to shareholders in the form of a dividend. The attractive aspect of a business is that you get to participate in “your” growing business as a stake holder. This is of course a double-edged sword! If the company loses money, it will directly impact your stake in a company. If the company goes broke, you might lose everything (that can be true of bonds too, it’s just less likely)! Stock typically is traded in a market and company valuations (or re-evaluations) can significantly impact it’s value.

Inflation Risk:

Stocks adjust better to inflation and tend to have a better return over time (at a market valuation risk). A business can adjust product prices for inflation! Investments in say factory equipment or new technology should improve the companies value in the long-run. Bonds are presented as fixed principal and interest amount (usually) and are typically impacted by inflation. For this reason, many 401k hold stock when you are younger (to grow your fortune with companies) and add bonds as you age (to guarantee principal, while gaining a cash flow).

5. Emotional Rollercoaster vs Long-term investing?

Stocks are traded on either a secondary market (stock exchange) or primary market (Initial Public Offering). You can get access to through a brokerage like: TD Ameritrade, ETrade, Fidelity or Robinhood etc. These brokerages typically offer bonds as well!

Emotional Rollercoasters:

Owning stock can be an emotional rollercoaster!

Bad news and Facebook:

One of the first stocks I bought was facebook. It was during a controversy where Facebook was going to split it’s stock into two different classes (types). The company had been doing good stock price-wise and I wanted to put my money into it. Within a month, I found an academic study that treated Facebook like a flu epidemic and stated Facebook would disappear within 12 months. Having never invested, I was super sensitive about losing all my money and decided to sell the stock! The article trended on news outlets, but most investors were focused on the company fundamentals and so the stock price never budged. Instead, the stock price increased exponentially that year! It was the first lesson I had about listening too much to bad news!

Short-term Prices and Nvidia:

Similarly, I bought Nvidia as I knew that GPU (graphically processing unit) demand was increasing due to applications in AI and computer vision. They were the undisputed leaders in that sector and had outpaced their competitor AMD by a large margin. Reports indicated that AMD would get a new chip into market, which would capture some of Nvidia’s low to mid-tier video game market, but Nvidia would cement it’s lead in high-end gaming the following quarter. Their expansion into data centers made them an attractive choice as their revenue was expected to explode! (The reason I know this is news + 10k + reading specialists reports in that industry).

I decided to buy shares and thought I would hold them for the long run. Sadly, my gut and emotions defeated me this time. A report came out about a switch from hardware to software-oriented bitcoin mining that would negatively impact the short-term demand for Nvidia GPUs. The stock dropped 10%. My emotions got the better of me and I sold! 3 months later, I found out that Nvidia recouped the price difference and increased by another 20%. My second lesson, if you are interested in a firm long-term, you should become less sensitive to daily price fluctuations (unless the company is going bankrupt, involved in fraud or a big assumption about growth changes…ok quiet a bit).

When you buy a single stock, you have to tolerate speculation, bad news and possibly daily price fluctuations. You will also be surprised at what impacts the stock market as a whole (Trump tax cuts).

Note: I am not advocating either Facebook or Nvidia stock. I’m using it to show how investment behavior changes when you own a stock!

Long-term investing:

Owning individual stock ties you to the fate of a single company. That means you are exposed to bad news (or speculative news) as well as greater fluctuations in price. A way around that is to own multiple companies!

ETFs

An alternative to investing in individual companies is to invest in: ETFs (or mutual funds) and/or bonds. Bonds I spoke about previously, but it’s worth talking about ETFs.

ETFs represent a slice of many companies (or bonds). You can for example own a piece of the top 500 companies by investing in a S&P 500 index fund (like VOO or SPY). The nice thing about ETFs is that they buy stock in bulk by pooling capital from many investors. They then create slices from the fund that are significantly cheaper than buying each individual stock separately.

In our example, if the average cost of a stock was $20, you’d need $10,000 to purchase each stock (as an individual investor). An ETF gets around this $10,000 cash requirement by collecting say $100 from 100 investors and then giving each ETF holder a single share representing a 1% stake in those 500 shares!

ETF diversification

Why would having a 1% stake in 500 companies be worthwhile? First, those 500 companies might operate in different sectors of the economy. One company might be a retail giant, while another represents a utility company. If the retail giant competes with amazon and begins losing customers it’s stock price might decrease. This decrease in stock price probably won’t impact utility industry! So the loss from the retail giant might be offset by an unrelated price increase from the utility company! Of course, this works against you as well! If a company is doing really well, it might be offset by a failing industry! Overall, a well-diversified ETF tends to have more stable daily price fluctuations with fewer large dips or huge gains (well-diversified part is key). This is why ETFs and mutual funds (a similar concept) are often used by investors that don’t want to actively manage their investments (known as passive investors).

Since you rarely know all 500 companies in an ETF, you tend to be less impacted by bad news or price fluctuations (due to diversification) compared to owning a single stock.

ETF interesting notes

Some other interesting notes about ETFs. ETFs often have a dividend. Dividends are cash paid back to an investor for holding onto the stock for a set amount of time (typically represented as a % of the stocks value). Dividends can often be reinvested into ETFs at a fractional rate (this is called a DRIP – Dividend reinvestment program). ETFs often have a management fee, which can be anywhere from .02% to 2%+ of the investment value. This management fee is typically taken out of the stocks gains or principal. ETFs can also be leveraged meaning the fund takes loans out to buy more stock (at interest rate) or have higher turnover which means that it trades stock more often increasing trading fees. You typically have to read the prospectus, a document explaining the fund, to see if it is leveraged or has a high turnover rate (sometimes not mentioned).

ETFs compared to 401k/IRA

Have you ever wondered how stocks/bonds relate to your 401k and IRA. Many 401k funds are composed of a mix of Stocks and Bonds. Stocks tend to be split between domestic and International stock (at least in the US). Younger individuals or those that elect a more aggressive portfolio will have more stock and international stock in their fund! Stock is an equity position that tends to perform well over long time frames.

Older individuals will see more of their portfolio dedicated to bonds. This is due to the fact that bonds, a liability position, tend to be safer in the short and medium term. Remember bonds are loans that aren’t directly attached to the valuation of the company and get paid out first when a company goes bankrupt. Bonds, however, tend to be more sensitive to inflation in the long run (unless it’s an inflation protected bond).

Many retirement funds behave similar to ETFs or mutual funds, because they are a diversified positions. One major difference between the typical ETF and retirement fund is that ETFs tend to be more specific (often less diversified) to an industry, country or the economy. They also tend to be less diverse in terms of types of investments. A retirement fund will often have bonds, stocks, international stocks and possibly CDs. An ETF tends to focus on only one of those (an ETF focusing on bonds is called a bond fund).

Another difference, retirement funds have government sanctioned tax advantages. In return for the tax shelter, you are not allowed to withdraw from your 401k or IRA until retirement age (or risk a 10% penalty).

Summary

I’m still relatively new to the stock market and trading. I’ve gained some confidence over time by reading more about the topic and trying to put a little extra money into my brokerage! Hopefully the article is useful for other beginning traders or people interested in how the stock market works!