Introduction:

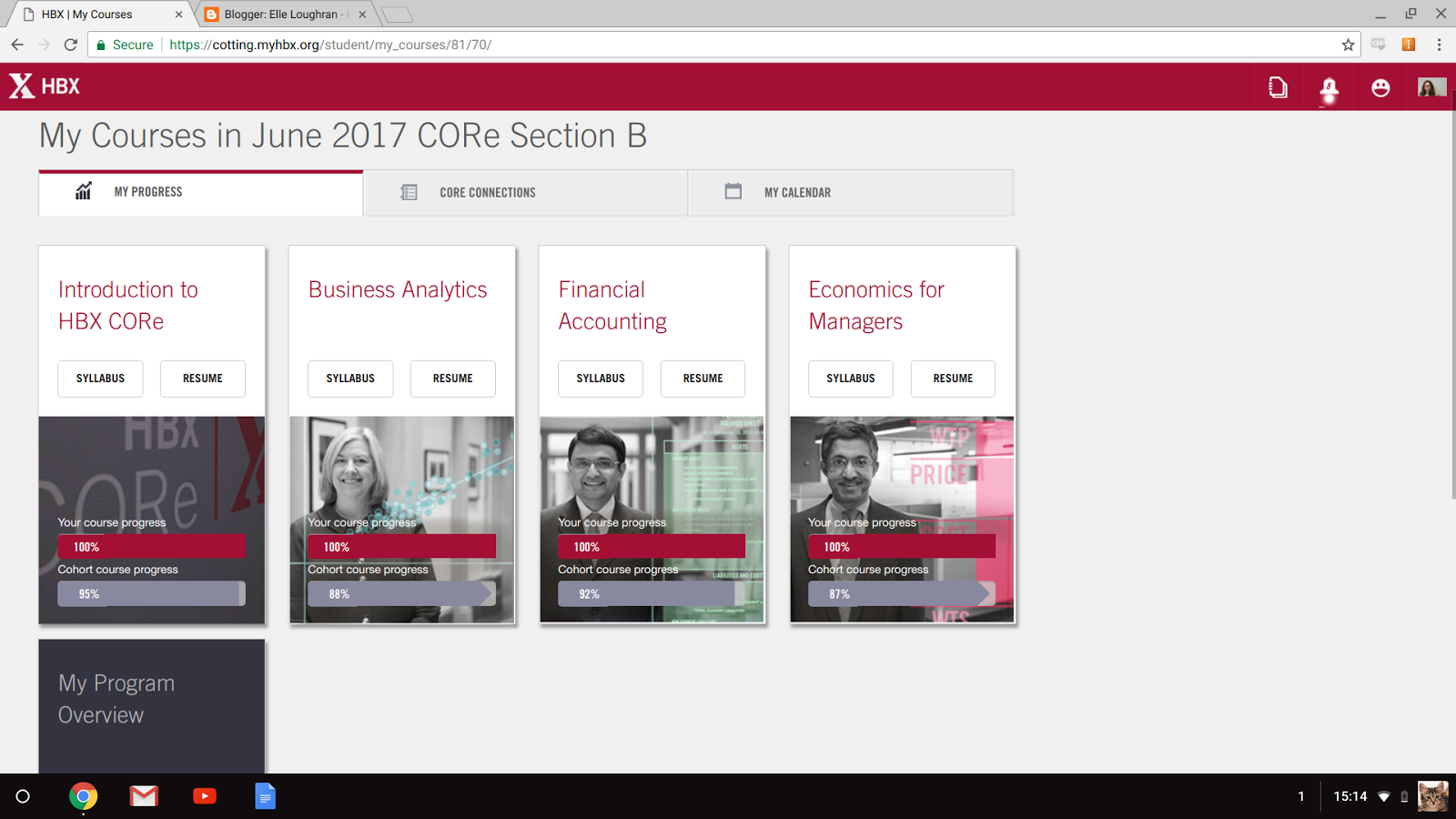

Harvard Business school runs HBX – Core, an online business learning platform. HBX Core is composed of 3 classes: Accounting, Statistics and Economics for Managers all targeted at improving your business understanding and becoming a better manager. Once you complete all 3 courses, you get the: credential of readiness. What does the course cover?

Financial Accounting:

The course covers accounting transactions, financial statements and some basic financial analysis/forecasting. It covers some accounting principles as well (historical pricing, consistency..). It’s a great course if you want to understand accounting basics. The instructor uses real life examples in his course including Cardullo’s located in Cambridge, Ma next to Harvard as well as Bikram Yoga, a yoga study in Natick, Ma.

Statistics (Business Analytics)

This course covers descriptive statistics: mean, median and mode, hypothesis testing, confidence intervals and regression (both single and multiple). This is similar to an 1st or 2nd class in statistics. It’s in my opinion a bit more intuitive in it’s explanations than the course I took in college. One highlight of the course is it’s emphasis on statistic calculations n Excel, which are mostly single formula based.

Economics for Managers

This is an economics course that focuses almost exclusively on microeconomics. The class can be evenly split into two parts: demand vs supply with the last portion emphasizing the intersection (market). This course is cool in that all the examples are really intuitive. You will explore demand curves by answering polls, supply curves by looking at the entire aluminum industry in an interactive graph, price wars by using financial statements and short vs long term markets by looking at the short/long term demand for lawyers. This course also covers alternative distribution methods such as queues, the formation of secondary markets during a price ceiling, different types of auctions and the two-tariff price model (subscriptions that lower the average price charged per unit). I liked this course the best.

Alternative

Something very similar in nature to the above program, but requiring significantly more time: CFA level 1. CFA level 1 is 1 of 3 exams to become a Chartered Financial Analyst, a designation valued in the investor industry. It covers ethics around investing, statistics focused on investments, financial statements, micro and macro economics (focus on interest rates and monetary policy). The section dedicated to finance is twice as long as all the other sections combined.

Summary

Overall, it’s a descent program if you are interested in learning business fundamentals. It’s also reasonably priced ($1950) and offered by a credentialed university (Harvard), which means you can expense it under most firms education reimbursement policy.